As Bruce Buffer screams, ” ITS TIMMEEEEEE “

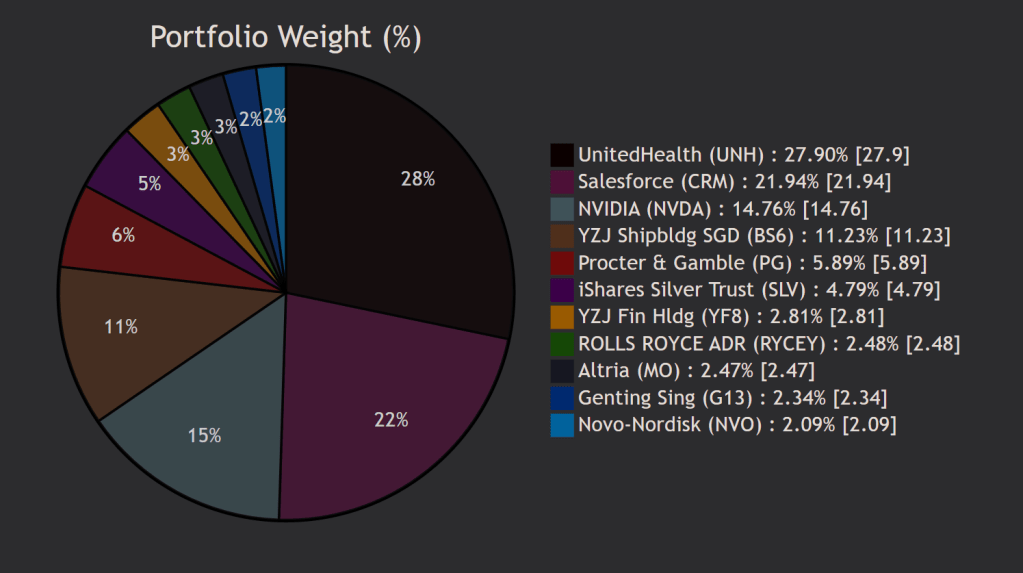

As of 30/11/2025

| Symbol | Name | % of Portfolio | Currency | Sector / Industry | Market Cap Size |

|---|---|---|---|---|---|

| BS6 | YZJ Shipbldg SGD | 11.23% | SGD | (Maritime) | (To Add) |

| CRM | Salesforce | 21.94% | USD | Technology / Software | Large-Cap |

| G13 | Genting Sing | 2.34% | SGD | (To Add) | (Mid-Cap) |

| MO | Altria | 2.47% | USD | Consumer Defensive / Tobacco | Large-Cap |

| NVDA | NVIDIA | 14.76% | USD | Technology / Semiconductors | Mega-Cap |

| NVO | Novo-Nordisk A/S | 2.09% | USD | Healthcare / Pharmaceuticals | Large-Cap |

| PG | Procter & Gamble | 5.89% | USD | Consumer Defensive / Household Products | Mega-Cap |

| RYCEY | ROLLS ROYCE ADR | 2.48% | USD | Industrials / Aerospace & Defense | Large-Cap |

| SLV | iShares Silver Trust | 4.79% | USD | (Commodity) | ETF |

| UNH | UnitedHealth | 27.90% | USD | Healthcare / Managed Care | Mega-Cap |

| YF8 | YZJ Fin Hldg | 2.81% | SGD | (To Add) | (To Add) |

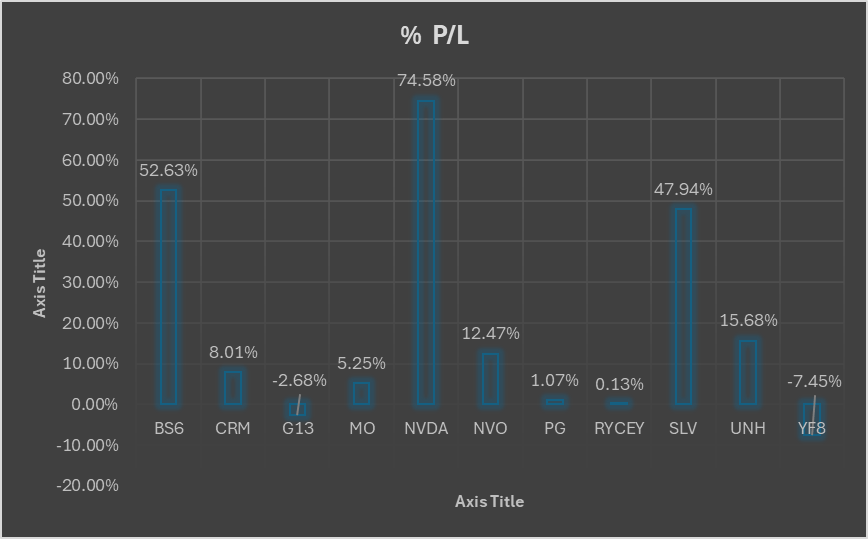

My Performance vs. Benchmarks:

My Yield— Money-Weighted: +47.62% (10/10 risk manager phew)

- HSI: +29.46%

- S&P 500: +16.45%

- CSI 300: +15.36%

- Nikkei 225: +24.00%

- STI: +19.78%

- NASDAQ: +21.00%

Portfolio Sector Allocation

| Sector | Holdings | Portfolio Weight |

|---|---|---|

| Healthcare | UNH, NVO | 29.99% |

| Technology | CRM, NVDA | 36.70% |

| Industrials | B56, RYCEY | 13.71% |

| Consumer Staples | PG, MO | 8.36% |

| Financials | YF8 | 2.81% |

| Commodities (ETF) | SLV | 4.79% |

| Consumer Cyclical | G13 | 2.34% |

| Total | 11 holdings | 100.00% |

My Approach: Seeking Growth, Demanding a Margin of Safety

Referring to earlier, my heavier allocations have been on stocks with already huge growth or potential growth. I temper this ambition with a strict entry discipline. Most of my entries have been below company intrinsic value and or below the 52 Week moving average. This is a mixture of short- and long-term holdings. Roughly 10% of the portfolio is constructed based on realized returns, giving me a margin of safety.

The Primary Goal: Skill Acquisition Over Short-Term Gains

At this early stage of my journey, I place emphasis on understanding how share purchasing, entries and market movement affect each other. In short, I’m learning to fall down and get up quick on a smaller scale. That way I can walk confidently when managing greater resources in the future.

My Most Valuable Chart: The Learning Curve

As you can see in the first 3rd of this year (2025), It wasn’t pretty I and was behind most indexes. These mistakes laid the foundation to many of the content you see here now, more than what any win would make me feel. They are the direct inspiration for the frameworks, decision matrices, and rigorous logs you see throughout this lab. They transformed emotion into process.

A quote from Warren Buffet: ” The stock market is designed to transfer money from the impatient to the patient.”